iink Corp + Momnt

With Momnt, you can close more deals, increase your average ticket size, and get paid faster.

-

Zero startup costs and no monthly minimums

-

Real-time decisions and instant funding

- 100% digital platform - no paperwork ever

-

Funds can only be spent at your business

Ready to get started?

What is Momnt?

Momnt is a financing platform that enables home service professionals to offer instant financing for job quotes. Unlike other solutions, once the client is approved they can only use those funds with you, no quote shopping!

Convenient for your Customers

Momnt makes it easy for your customers to utilize financing, with soft credit pulls and instant pre-qualified offers for great promotional financing options.

Soft Credit Pulls

Instant Offers

Promotional Loans

Great for Contractors

Momnt makes it easy for home service professionals to win more business by offering exclusive, instant financing.

-

Get paid fast

-

Exclusive offers - no quote shopping!

-

Low merchant fees

Primary Use Cases

1. Deductible Financing

Deductibles can reach as high as 2% of the appraised value of each insured property. With median home values in the United States estimated to be $425,000.00 representing over $8,000.00 in deductible costs the property owner will need to come up with or that the contractor oftentimes needs to float on behalf of their client. In some states like Texas, the remainder of the insurance claim funds won’t even be released until the carrier has proof that said deductible has been paid, which can put even greater stress on the contractor and their client.

iink’s partnership with Momnt will allow Momnt’s contractor clients to offer deductible financing to its customers on deductibles as low as $3100.00.

2. RCV Gap Financing

In states like Florida, many carriers are beginning to opt for ACV (actual cash value) only policies meaning: they will not cover the full replacement cost of the property damage. This could in addition to the deductible leave the property owner on the hook for thousands extra if they wish to restore the property back to its pre-loss condition.

iink customers will now have the ability to offer unsecured financing options to their clients to help cover these additional expenses with promotions like six months of deferred interest.

3. Retail Upgrade Financing

The period of time after an insurable property loss represents one of the most opportune times to invest in larger renovation projects. At this point, contractors have already been identified and the home is already under construction. However, the insurance proceeds won’t cover upgrades. Perhaps the property owner would like to upgrade from asphalt shingles to Spanish tile or would like to install skylights—they would not be able to in the current state.

If the property owner is unable to cover those upgrade costs, iink clients can leverage the partnership with Momnt to provide financing options to property owners who have such needs.

In addition, all iink Verified customers will have access to discounted rates on financing not available to the general public and is only accessible through iink’s portal.

To utilize the perks of this partnership, sign up today or contact us to learn more.

"Momnt has been amazing to work with and they have truly shown an interest in helping my business grow. The first time I offered financing through Momnt, my customer decided to add an additional $18,000 to the size of the project!."

Increase in Sales

Increase in order value

Max Loan Size

Promotional financing is a powerful tool that allows your customers to pay for unexpected expenses on their homes, or to afford larger planned projects. Offering financing options to your customers can help to boost your sales volume, increase customer loyalty, provide upsell opportunities, and give you access to customers at their point of need.

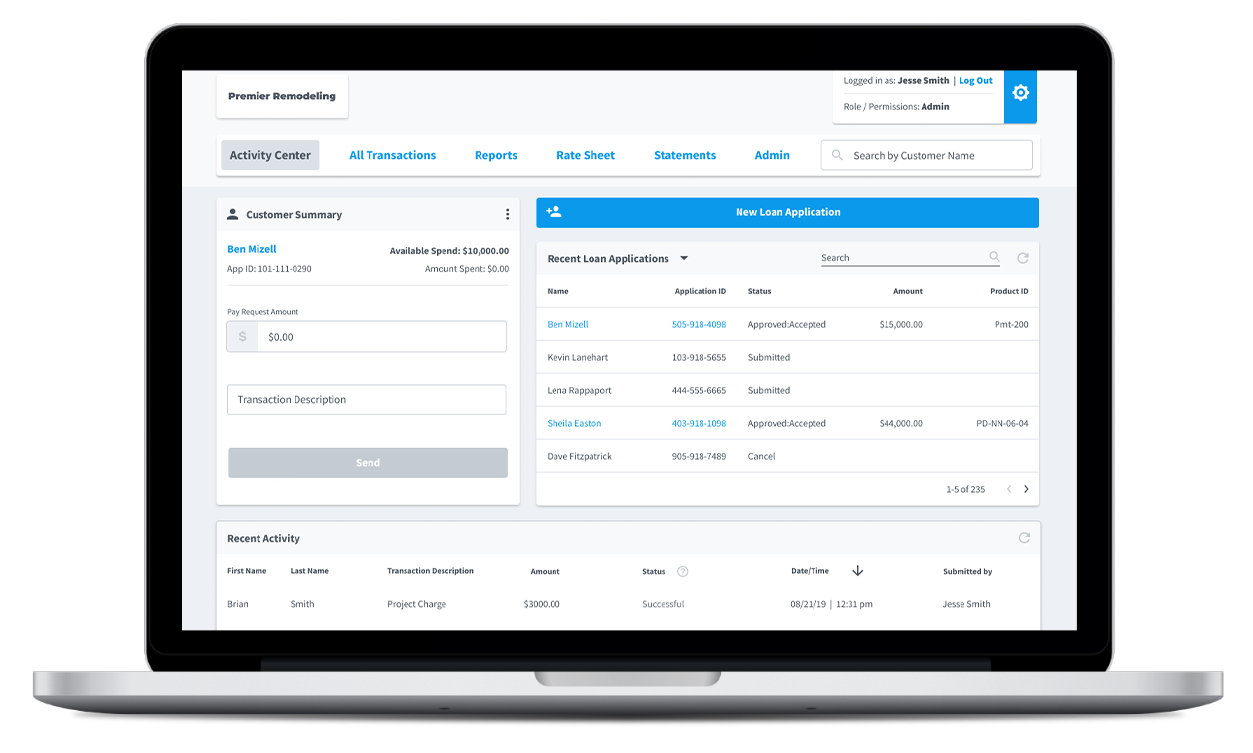

Simply put, no other platform is easier to use for you, or your customers. With soft credit pulls, your customers can shop worry-free. With closed-loop funding, your customer can only transact with you, no quote shopping! With staged funding capability, you have the tools you need to control your cash flow.

Simply initiate a transaction request from your merchant portal. Your customer will instantly receive a text message to confirm the transaction, and funds will be sent to your bank account in 1-3 business days via ACH.

We charge highly competitive merchant fees at the time of transaction. No start-up costs, no recurring monthly costs, no annual costs. Only get charged when your customer pays you.

Click on the button below or fill out the form at the top of the page and one of our sales representatives will reach out to you with a unique link to apply. After that, it's a short, online application with instant approval.

Momnt offers over 30 loan products with loan amounts from $3,100 to $55,000, APRs from 0.00% to 23.99%, and terms from 24 to 120 months. Promotional financing offers include same-as-cash, fixed interest rate, fixed payment, and zero-interest installment loans. Loans are made by participating lenders and subject to credit approval.

Want to learn more?

If you'd like to learn more about Momnt and receive a demo tailored to your business, complete this form and a sales representative will reach out to you shortly.